Strength and conditioning coaches and applied sport scientists often face limited career pathways: team roles, private facilities, or teaching positions. These options can be competitive, unstable, and have a low ceiling. Meanwhile, the sports technology industry is expanding at pace. From wearable sensors and biomechanics platforms to recovery tools and AI-driven analytics, new companies are shaping training, monitoring, and recovery.

The difference between applied sport and industry lies in what each measures. Coaches focus on readiness scores, acceleration speeds, bar velocity, or injury rates, while companies track user adoption, engagement, and retention. The vocabulary differs, but the process is familiar: build a system, test it, measure outcomes, and refine. And both sectors share an overarching goal: improving health and human performance.

The structures of the sports technology sector parallel the systems coaches already use. Just as coaches design programs and monitor adaptation, companies design products and monitor adoption. The added layer is business: understanding how organizations fund growth, select business models, and adapt to market demands. For practitioners, recognizing these entrepreneurial dynamics provides a clearer view of why products take the form they do and where applied expertise has the greatest influence.

Company Structures and Operating Models

The stage of a company dictates both the pace of work and the type of evidence required. Start-ups emphasize speed and proof of concept; corporates prioritize precision, compliance, and regulatory approval. Companies in the sport performance technology sector generally fall into three categories: start-ups, scale-ups, and established corporations. Each stage of development brings its own pace of work, resource availability, and expectations for evidence.

Start-ups are typically very small organizations, often with fewer than twenty employees, and they operate with limited financial and human resources. Their focus is on quickly developing prototypes and securing early adoption from users. Because their survival depends on proving a concept on a short financial runway, they rely on short development cycles and frequent pivots based on direct user feedback. In this environment, speed is valued over precision, employees often wear many hats, and “good enough” data is often prioritized to show market potential.

Scale-ups represent the next stage of growth. These companies have secured external investment, often through venture capital, and achieved initial market traction. Their challenge is expansion: moving beyond a small group of early-adopting clients into larger institutional or consumer markets. Dedicated teams are created for research and development, marketing, and regulatory affairs, and there is greater pressure to balance innovation with reliability. Scale-ups must demonstrate that their products work and can be delivered consistently, at scale, and with measurable value to diverse customers.

Corporations represent the most mature phase. These organizations have substantial resources and well-defined structures in research and development, regulatory compliance, marketing, and product distribution. While they move more slowly than start-ups or scale-ups due to larger organizational complexity and multiple decision-making layers, they are able to deploy validated products at a global scale and innovate more freely with comprehensive product testing and future product development.

The stage of a company dictates the pace of development and the type of evidence required. Start-ups prioritize speed and proof of concept, relying on applied testing and rapid iteration to refine products. Scale-ups demand validation that products work beyond a niche environment, often requiring applied science that demonstrates reliability across broader populations. Corporations prioritize precision, compliance, and formal approval, requiring robust validation studies and regulatory clearance before a product reaches the market.

Business Models in Sport and Performance Technology

Business models determine how companies generate revenue and, by extension, how products are prioritized and evaluated. Several models dominate the sport technology sector:

Business-to-Business (B2B): This model involves selling directly to teams, leagues, or training facilities. B2B companies typically work with a smaller number of clients, but the stakes are higher. Reliability, accuracy, and long-term relationships are critical, as these customers demand evidence-based validation before committing to adoption.

Direct-to-Consumer (DTC): Companies following a DTC model sell directly to individual athletes and fitness enthusiasts. The scale of users is larger than in B2B, but sustaining engagement is more difficult. DTC businesses often combine physical products with software-as-a-service (SaaS) or subscription models, where recurring revenue is generated from ongoing access to data, analytics, or performance insights.

Hybrid Models: Many companies operate across both B2B and DTC channels, combining hardware and software to serve institutional clients as well as individual users. For example, professional teams may use GPS systems for load management, while recreational athletes use a simplified version of the same technology for personal fitness tracking.

Licensing and White-Label Models: Some companies do not interact directly with athletes or coaches. Instead, they license proprietary algorithms—such as sleep staging, HRV analysis, or pose estimation—to larger companies that integrate these capabilities into their own platforms. This approach enables technology developers to scale rapidly without needing to build consumer-facing products.

Service-Based Models: In some cases, companies integrate consulting, education, or testing services alongside technology. These models rely on applied expertise to deliver value and may include performance assessments, workshops, or certification programs. While technology provides the infrastructure, the service component establishes credibility and builds long-term customer engagement.

The chosen model influences design priorities. B2B companies emphasize accuracy because professional organizations demand it, while DTC companies often optimize for usability and long-term engagement. Service-driven models rely heavily on credibility and applied expertise.

Sector Examples and Applications

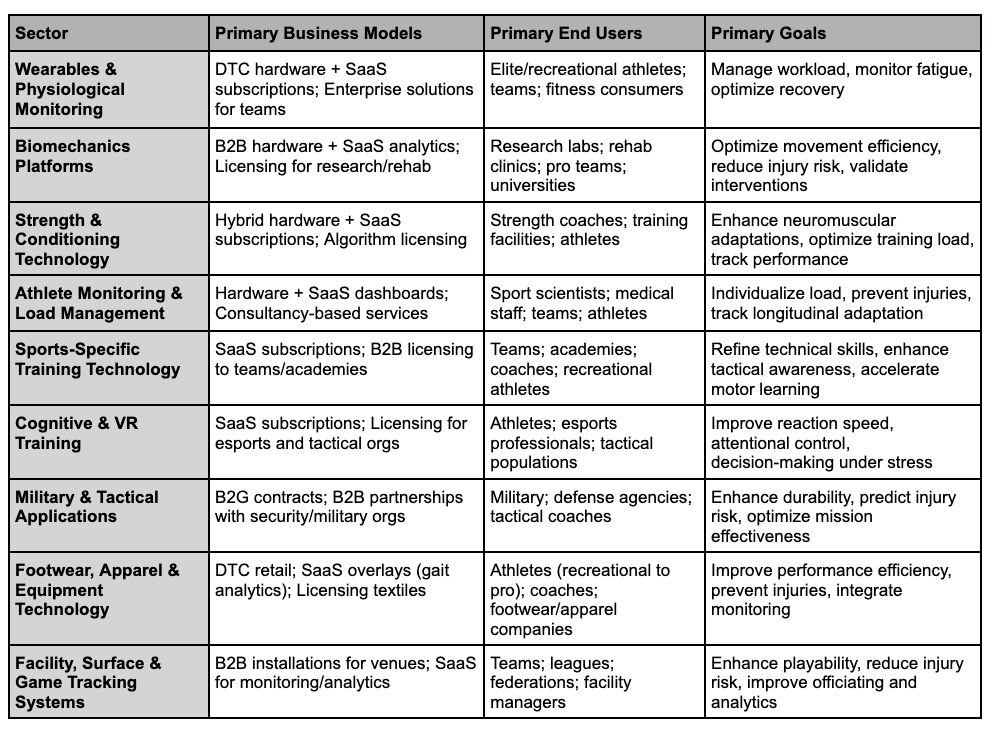

The diversity of the sports technology industry highlights how technical innovation is paired with revenue strategies. Each sector aligns its business model with the requirements of its end users, whether that means prioritizing precision for elite teams, scalability for consumer fitness, or compliance for government contracts.

Wearable Technology encompasses devices such as GPS trackers, heart rate variability monitors, electromyography sensors, and sweat analysis platforms. These companies primarily adopt direct-to-consumer models, selling hardware at low margins while generating recurring revenue through subscriptions. Enterprise offerings for professional teams and institutions emphasize higher-level data integration. The primary goals are workload management, fatigue monitoring, and recovery optimization.

Biomechanics Platforms include motion capture systems, force plates, and gait analysis tools. Operating predominantly on business-to-business or software-as-a-service models, they target research labs, rehabilitation clinics, and professional teams. Business sustainability depends on licensing cloud-based analytics for long-term monitoring, emphasizing precision, repeatability, and validated outcomes.

Strength and Conditioning Technology incorporates velocity-based training devices, innovative gym equipment, and blood flow restriction systems. These companies often follow hybrid models, combining hardware sales with SaaS subscriptions for analytics dashboards and performance tracking. Their focus is on enhancing neuromuscular adaptations, optimizing training efficiency, and tailoring load prescription.

Athlete Monitoring and Load Management integrates internal measures such as HRV, biomarkers, and sleep with external load tracking through GPS, accelerometry, or force plates. Platforms provide dashboards for coaches and medical staff, enabling individualized training and recovery management. Business models typically combine hardware sales with subscription analytics, with some organizations adopting consultancy-based services.

Sports-Specific Training Technology delivers tools that target particular skills or tactical elements, including swing and stroke analyzers, ball-tracking systems, and VR-based tactical decision-making platforms. Business models generally combine SaaS subscriptions with B2B licensing, reflecting the need to serve both teams and individual athletes.

Cognitive Training and Virtual Reality Systems use immersive simulations, eye-tracking, and neurofeedback to improve reaction time, decision-making, and attentional control. These companies emphasize scalability and typically operate on SaaS or licensing models, making their products adaptable across sport, esports, and tactical domains.

Military and Tactical Performance Technology adapts sport science principles to military and law enforcement populations. Solutions focus on physiological monitoring, injury prediction, and stress resilience, with business models centered on business-to-government contracts and B2B partnerships. Compliance, durability, and validation are critical requirements.

Footwear and Equipment Technology embeds sensors in shoes, insoles, and equipment to provide real-time biomechanical and performance feedback. These products primarily follow direct-to-consumer and retail models, with some SaaS overlays that provide additional analytics.

Technical Apparel and Smart Textiles combine performance fabrics with biometric monitoring, integrating sensors to capture heart rate, respiration, or muscle activity. Companies in this sector often sell directly to consumers but may also license textile technologies or provide SaaS analytics for monitoring.

Facility and Surface Technology covers innovations in turf, courts, and playing surfaces that optimize safety, performance, and consistency. These solutions operate under a business-to-business model, selling installations to professional and recreational facilities, sometimes with SaaS monitoring platforms for maintenance and usage analytics.

Game Tracking, Officiating, and Broadcast Technology provides real-time tracking, event detection, and officiating support, while also enhancing media analytics. Operating under B2B or SaaS models, these systems primarily serve leagues, federations, and broadcasters that require accuracy, integrity, and data visualization.

Esports and Cognitive-Performance Technology focuses on monitoring and improving visual tracking, decision-making, and cognitive load in digital performance environments. These tools are delivered through SaaS subscription platforms marketed to both teams and individual users, with growing overlap into traditional sport.

Here is a breakdown of each sector and its business models, end users, and goals:

Key Parallels

Key Parallels

The sports technology industry is not a separate world from applied sport science, it operates on the same foundations of system design, measurement, feedback, and iteration. What differs are the objectives and the language. Coaches and sport scientists evaluate training loads, readiness, and adaptation, while companies evaluate adoption, engagement, and growth. Both seek sustainable performance, but the unit of analysis shifts from athlete to user, and from physical output to business outcome.

Across start-ups, scale-ups, and corporations, the stage of a company determines its pace of development, resource allocation, and evidence requirements. Different business models provide a framework for understanding how products are designed, tested, and marketed across the sports technology sector. The applied insights of sport science—whether through validation, compliance monitoring, or practical translation—are central to success.

For strength and conditioning coaches and sport scientists, the parallels are clear. Both fields require planning, monitoring, and adaptation, but in different contexts. Recognizing these parallels means you’ll better understand the ecosystem your profession now sits alongside. The same way performance science shapes athletes, it’s also shaping products, platforms, and companies that influence sport on a global scale.

Connect with the Author:

IG profile

LinkedIn Profile

Part 2 coming soon: Funding mechanisms, business and marketing metrics, and product cycle workflows within sport technology